Top Lines 5

Tariffs, Abundance, and Pursuing Agency

What I’m Writing

Best Ball Summer: Opening ADP Review — First week of BBM

Best Ball Summer: Early My Guys — Second week of BBM

What I’m Thinking About

Can we steelman the tariffs? Probably similar to many of you, the recent tariffs have been on mind, and hot takes about them are littered across my news feeds. Consensus from economists and the general public is that tariffs are inefficient and a tax on consumers, as many of us who took a 101 economics class would attest. However, given tariffs are likely to feature heavily in U.S. economic policy over the next few years, I sought out the strongest possible case for them.

To that end, this paper titled A User’s Guide to Restructuring the Global Trading System, was written in November 2024 by the now head of the U.S. Council for Economic Advisors. In it, the author states:

“There is a path by which these policies can be implemented without material adverse consequences, but it is narrow, and will require currency offset for tariffs and either gradualism or coordination with allies or the Federal Reserve on the dollar. Potential for unwelcome economic and market volatility is substantial, but there are steps the Administration can take to minimize it”

The author details why the tariffs are necessary, what the path to success it, and how to measure it.

I’ve distilled the argument into the following key points.

There’s a structural economic issue… “As the United States shrinks relative to global GDP, the current account or fiscal deficit it must run to fund global trade and savings pools grows larger as a share of the domestic economy. Therefore, as the rest of the world grows, the consequences for our own export sectors--an overvalued dollar incentivizing imports--become more difficult to bear, and the pain inflicted on that portion of the economy increases.”

…that’s harming the United States’ domestic industries… "Synthesizing these properties of reserve assets, if there is persistent, price-inelastic demand for reserve assets but only modestly cheaper borrowing, then America's status as reserve currency confers the burden of an overvalued currency eroding the competitiveness of our export sector, balanced against the geopolitical advantages of achieving core national security aims at minimal cost via financial extraterritoriality."

…and that is forcing the US into a trade-off between export competitiveness and financial power projection. "The tradeoff is thus between export competitiveness and financial power projection."

The tariffs can solve this by increasing revenue and reducing demand from the country imposing tariffs… “trade economists argue that for a large economy, imposing a positive tariff level is modestly welfare enhancing, up to a point. Classically, modest tariffs can improve welfare because reduced demand from the tariff imposing country depresses prices of the imported goods.”

…but it takes time… “While the tariff produces distortionary welfare losses due to reduced imports and more expensive home production, up to a point, those losses are dominated by the gains that result from the lower prices of imports. Once import reduction becomes sufficiently large, the benefits from lower prices of imports cease to outweigh the costs, and the tariff reduces welfare.”

…and needs a stronger currency to avoid significant drawbacks, including inflation. “If the currency markets adjust1, tariffs can have quite modest inflationary impacts, between 0% and 0.6% on consumer prices.”

Short-term volatility is expected... “A sudden shock to tariff rates of the size proposed can result in financial market volatility. That volatility can take place either through elevated uncertainty, higher inflation and the interest rates required to neutralize it, or via a stronger currency and knock-on effects thereof.”

…and there are numerous risks, as this type of trade policy by a large country hasn’t been tried in decades. “It is worth repeating that many of these policies are untried at scale, or haven't been used in almost half a century, and that this essay is not policy advocacy but an attempt to catalogue the available tools and analyze how useful they may be for accomplishing various goals.”

After summing those key points together, the argument is this:

There is a structural economic issue that is harming the United States’ domestic industries, and that is forcing the U.S. into a trade-off between export competitiveness and financial power projection. The tariffs can solve this by increasing revenue and reducing demand from the country imposing tariffs, but it takes time, and needs a stronger currency to avoid significant drawbacks, including inflation. Short-term volatility is expected, and there are numerous other risks, as this type of trade policy by a large country hasn’t been tried in decades.

So far, we have seen short-term volatility, but perhaps more concerning, is that the dollar has actually weakened. A stronger dollar was a core feature to the steelman argument, as it would reduce the short-term negative impact on American consumers, to allow for the long-term benefits to take hold. Instead, with the dollar weakening, the negative impact will likely be greater on American consumers, potentially amplifying any inflationary effects the tariffs created. Ultimately, while the steelman case was theoretically compelling, the practical outcome has not achieved its stated outcome or followed the narrow path the author laid out.2

And on that cheerful note, the first two articles below detail why this might just be a systemic issue that the United States has to navigate.3

What I’m Reading

Economy

It's time to start panicking about the national debt

Short history of the rise in U.S. federal government debt since 1980.

Key Quote: This is why some economists view government debt as inevitably inflationary — intentionally inflationary policy represents a way of partially defaulting on government debt, so when people see the government borrowing at unsustainable rates, they may anticipate that this gives the government an incentive to pump up inflation. And this can become a self-fulfilling prophecy, as businesses rush to increase their prices ahead of everyone else.

My Takeaway: Assuming the United States is unable to reduce its spending/deficit, it’s likely we’ll see higher levels of inflation in the near future.

This is called "capital flight"

Key Quote: For the first time in many decades, the U.S. has experienced capital flight. And if it continues, the consequences for the U.S. economy could be absolutely dire. When their currencies crash, countries are forced to halt imports, making their consumers suddenly poorer and fueling inflation. When their interest rates rise, countries experience economic recessions, and they may even come under pressure to default on their debts. Basically, when investors start stampeding for the exits, it’s bad news.

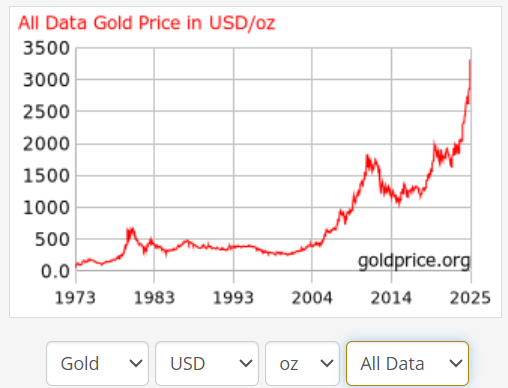

My Takeaway: We’ll see if capital flight continues, as the tariffs were reduced to the unilateral 10%, and some exemptions were made, which look to have stabilized the situation for the short-term. However, between the national debt and the at least one-off example of capital flight in response to the tariffs, there is some risk that economic volatility and inflation is just a structural/systemic issue. In that scenario, it’s worth figuring out how to best navigate another serious bout of inflation, as micro policies (like tariffs or free trade) may only accelerate/decelerate what is happening at the macro level. My understanding is that during inflation it’s usually best to own “hard” assets like gold, real estate, and commodities.4 5 As we can see below, gold is at an all-time high, suggesting the market is already pricing in inflation concerns.

Energy

The Moon Should Be a Computer

Key Quotes: Today AI workloads globally consume around 20 terawatt-hours per year and account for roughly 10% of total data center power consumption. These workloads are growing much faster than non-AI workloads and are on track to by 2028. If scaling laws hold, this means we can expect a massive increase in energy demand, outstripping current infrastructure... Some industry experts predict even as much as 4.5% of global energy to be used by AI workloads. There is one problem with this: we cannot continue to scale energy usage like this without making the Earth inhospitable to organic life...We would increase the temperature of Earth by at least 5 degrees Celsius, which is probably unsurvivable or undesirable at the very least.

My Takeaway: The author’s proposal is to essentially offshore the energy needs for AI to the moon, which is certainly my first time hearing that stance. While it is a radical solution, it reinforces that energy policy is at the center of everything. Even though mastery of energy sources has developed much of the world and increased the standards of living for billions of people, we still have so far to go, and the appetite for energy is only growing. There are many noble pursuits in the world, and working to optimize energy for the good of humankind has to be among the leaders.

Volts: What's up with clean energy in Finland?

Key Quotes: Quietly, without getting nearly the attention of some other countries one could name, Finland has become a global leader in decarbonization. Already, nearly 95% of its electricity comes from carbon-neutral sources, led by nuclear power. In 2023, Finland opened its fifth nuclear power plant; nuclear now provides close to 40% of the country's electricity.

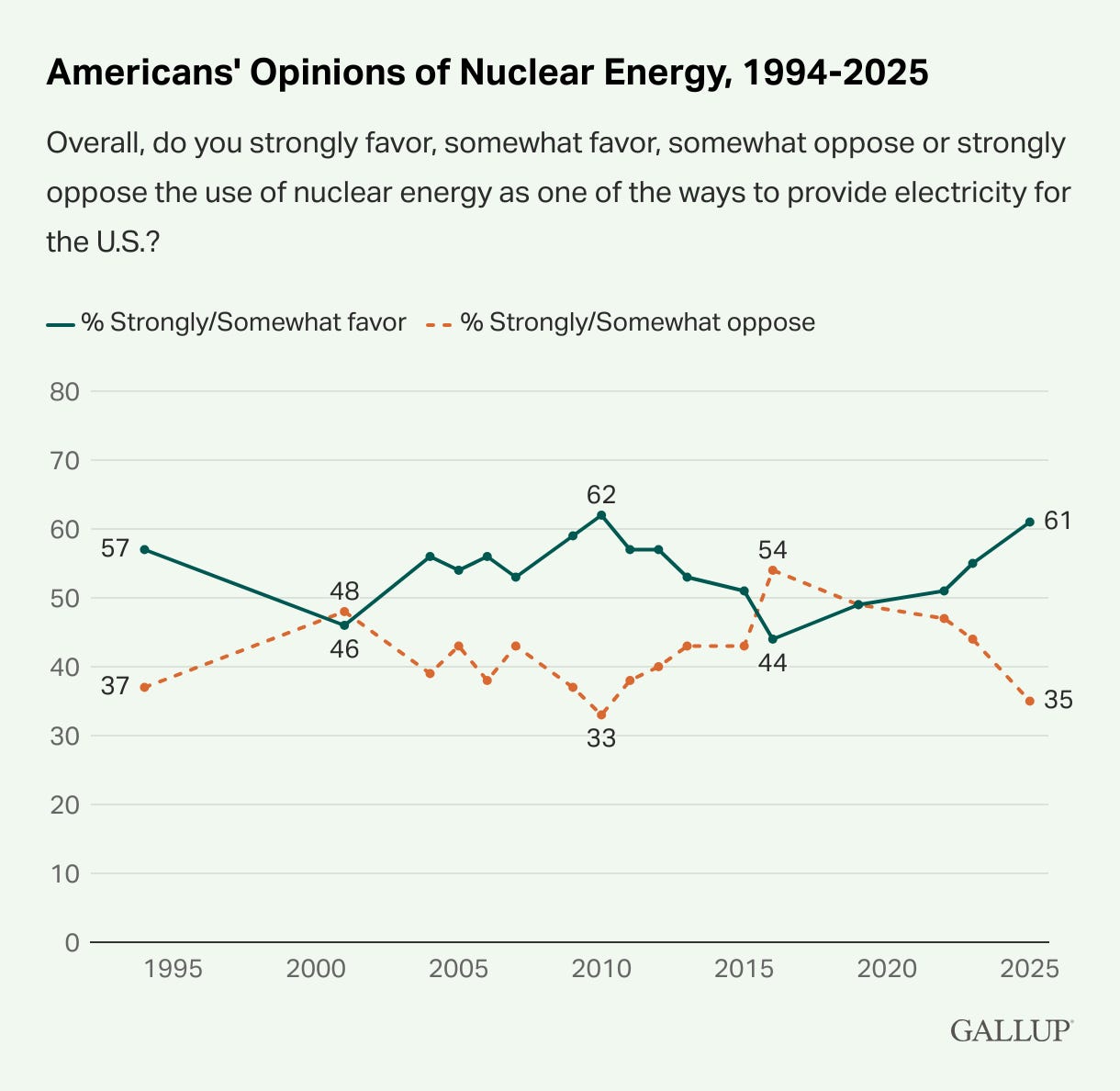

My Takeaway: I continue to be bullish on nuclear energy making a strong push, as there seems to be both a public/governmental positive shift in view on it, and a re-dedication towards results-oriented public policy (as we’ll see from Abundance below). In those scenarios, with nuclear being re-billed as an intensive and clean energy source with more efficient regulation, it’s easy to envision nuclear energy’s share of global energy expanding, right at the time when we need it most.

Sports

Thinking About Thinking: Breaking Down the 2025 Wide Receiver Class

Key Quote: However, who is the better separator? A WR who has 50 targets, 10 of which are contested, or one who has 100 targets, 30 of which are contested. Looking only at the contested target rate would lead you to flag the second player and not the first, when it seems highly likely the second player is the more effective separator of the two — he earned 30 more uncontested targets!

My Takeaway: Jakob would probably say that running back is his best position to evaluate, but I always come away impressed at how well his wide receiver evaluations balance the film and statistical information. He did that again here, and for any of you dynasty folks out there, this article will be highly useful for you. Other than head-nodding to the whole Travis Hunter section,6 I’d also point to his analysis directly impacting my perception of Emeka Egbuka, and acknowledging that my 4% in pre-draft best ball is too low.

Other Topics

Minimum Viable Muscle: The Least You Must Do To Not Fall Apart

Key Quote: Research shows that reducing training frequency to once weekly preserves only about 50-60% of strength gains, while complete cessation results in strength declining approximately 5-10% weekly… establishes the minimum daily movement threshold at approximately 22 minutes of moderate activity. Falling below this floor accelerates mortality risk substantially, with sedentary behavior strongly associated with increased all-cause mortality… Even single weekly high-intensity sessions maintain performance values, whereas moderate continuous activity alone results in gradual erosion of capacity.

My Takeaway: For any of you seeking to re-establish a new level of fitness, this article is a one-stop shop. As the quote above details, there’s a minimum threshold for daily movement and a need for roughly two actual training sessions each week. And, if you can add in just one intense workout each week, that is enough to maintain most of your physical capacity. All-in-all, with just 22 minutes of moderate movement (brisk walking or more) each day and 1-2 legitimate workouts each week, you can maintain your level of physical fitness.

How to Practice the Skill of Agency

Key Quote: Whatever it is, assume it can be learned and that the task is to figure out the best way to do it.

My Takeaway: After reading topics like the above, these articles are always a breath of fresh air. Put simply, you can just do things. Develop a bias towards action, assume everything is learnable, solve problems, and live with autonomy.

Books Update

Finished

The 5 Types of Wealth, Sahil Bloom — Rated 4/5 (influential)3

Summary: I first wrote a summary about the 5 Types of Wealth when I took the self-quiz a few months back. At its core, the book is about improving your Time, Social, Mental, Physical, and Financial Wealth. Bloom makes the read feel direct and conversational, while providing anecdotes that underscore why each is important and how it contributes to our happiness. After that, I was prompted to evaluate how I was doing in each category, and determine methods for how to improve. It’s a simple, free-flowing read, and one that I found both enjoyable and useful. I recommend it to anyone looking to check-in with themselves or family members and to those actively considering how to improve their current situation.

Abundance, Ezra Klein and Derek Thompson — Rated 3/5 (memorable)3

Summary: I entered with high expectations for Abundance based on the immense hype it had, and I ended slightly underwhelmed.7 To be sure, Klein and Thompson provide great examples of how government has prevented the achievement of the goals they set via self-inflicted wounds, including high-speed rail in California, affordable housing in cities, and in scientific research. To sum up Abundance in a sentence, they want government to work effectively again, and argue that a results-focused process is the way to do it. Most people probably agree with that, but it seems weird that the argument even has to be made. To that end, Klein did a podcast tour, and the verbal arguments he’s made do a better job of explaining what an Abundance agenda is, why it’s needed, and how it’ll bring the best version of America forward.8 I’m also reading the “conservative” version of Abundance now, and may do a side-by-side review of the two once I wrap it up.

In Progress:

My goal is to read 3 books at once: 1 non-fiction, 1 fiction, and one self-improvement.

The Back Mechanic — 75%

Which means the dollar gets stronger relative to other currencies

At least it hasn’t so far, and many of the original tariff levels have been reduced (to the unilateral 10% level) or include exemptions. I will note that the article did advocate specifically for a unilateral 10% tariff, and cited tariffs as “welfare-creating” up to the 20% mark, so it does seem the adjusted policies are more directly aligning with that intent. It’s at least plausible that helps to reduce the volatility and increase the chances of long-term success (though the weakening dollar and capital flight example remain bearish indicators).

I found Lyn Alden’s analysis of the tariffs to be particularly insightful here, and a nice counterpoint to the loud yelling “debate” that happened on the All-in podcast.

I’m not a financial advisor and this is not financial advice. Like many of you, I’m simply trying to figure out how to navigate this situation the best I can.

I’m also intrigued by bitcoin as a potential hard asset. It’s long been billed as “digital gold” by its believers, and to this point, we hadn’t seen much evidence of that (though I certainly understand the theoretical case for it). However, in recent weeks, it’s traded more like a standard stock, instead of a high-risk speculatory asset like other cryptocurrencies, and with less volatility than it has in the past. If that continues, it seems plausible that it does start fulfilling some type of digital gold role, which would probably be very bullish for it.

Jakob has Travis Hunter as WR1, and states that “I’m fairly comfortable that the Browns will draft Hunter, and that they plan to use him as a WR primarily.” His best ball price is starting to reflect the growing chance he will primarily play wide receiver, and like Jakob I’d put the chances at that of greater than 50% at this point, based on rumors that the Browns intend to draft him and their GM primarily views him as a wide receiver.